Introduction

In the dynamic landscape of 2025, mergers and acquisitions (M&A) are gaining significant momentum, fueled by the promise of strategic growth and competitive advantage. According to EY’s latest report, the M&A environment is thriving as organizations explore innovative ways to create value and navigate an increasingly complex global economy.

This surge holds immense potential as companies redefine their operations, venture into new markets, and adopt cutting-edge technologies. Today’s strategic deals are no longer limited to achieving cost efficiencies; they are increasingly centered on fostering innovation and enhancing sustainability. Cross-border M&A is also on the rise, offering organizations opportunities to access new customer bases and resources. Despite challenges such as geopolitical uncertainties and regulatory complexities, businesses are leveraging data-driven insights and digital tools to mitigate risks and streamline integration processes. This evolution reflects a broader recognition that successful mergers require alignment of both operational and cultural factors to unlock the full value of a deal.

However, these transformative events come with intricate challenges, from harmonizing diverse corporate cultures to ensuring seamless integration across borders. The true measure of an M&A’s success lies not just in the deal itself but in how effectively the two organizations integrate their cultures, processes, and people.

Understanding M&A Challenges

Mergers and acquisitions (M&A) are often seen as powerful tools for achieving strategic growth, expanding market reach, and fostering innovation. However, the path to a successful merger is rarely straightforward. While M&A deals promise immense potential, they also bring a unique set of challenges that can undermine their success if not addressed proactively. From aligning strategic goals and integrating complex systems to managing cultural differences and regulatory hurdles, these obstacles demand careful planning and execution. Understanding and addressing the major challenges in M&A is critical to unlocking the full value of these transformative business endeavors.

M&A initiatives are often fraught with challenges such as:

1.Cultural Integration and Misalignment

Culture is not just about processes but also about people, making it a pivotal factor in M&A success. According to McKinsey, 95% of executives believe that cultural fit is critical to successful integration. However, only 25% of organizations conduct a formal cultural assessment during due diligence. This gap often leads to post-merger challenges, as cultural misalignment is one of the primary reasons why 70-90% of M&A deals fail to achieve their intended value.

Merging two distinct organizational cultures presents significant hurdles, including values, work styles, and communication differences. These challenges can result in employee dissatisfaction, resistance to change, and even attrition. Fostering an environment of collaboration and shared values is essential to overcoming these obstacles and ensuring a successful integration.

2.Communication and Transparency Gap

Poor communication during M&A can lead to misinformation, rumors, and mistrust. Employees, stakeholders, and customers need clear, consistent messaging to stay aligned and engaged. As the saying goes, “The single biggest problem in communication is the illusion that it has taken place” (George Bernard Shaw).

Without open and transparent dialogue, even the most well-planned mergers can falter. In times of change, it’s crucial to remind our people: “We are here for you, and we are listening to you.” Effective communication isn’t just about sharing information—it’s about building trust and fostering connection. As Simon Sinek wisely said, “Communication is not about saying what we think. It’s about ensuring others hear what we mean.”

During M&A, leaders must prioritize transparent communication to address uncertainties, build trust, and align everyone around a shared vision.

3. Delegation and Integration Team Gap

The integration process in M&A is one of the most intricate and critical phases, requiring seamless collaboration across various teams to unlock the full value of a deal. However, a common pitfall arises when the diligence and integration teams operate in silos, creating gaps in knowledge and understanding. The diligence team, tasked with evaluating risks and assessing the deal’s potential, often works independently of the integration team, whose responsibility is to execute the post-acquisition strategy. This separation can lead to redundancies, misaligned priorities, and delays.

Without early and clear communication, integration teams may lack the insights needed to address practical challenges, such as aligning operations, processes, and people. This disconnect often results in avoidable inefficiencies, including repeated assessments or adjustments, as integration teams grapple with unforeseen obstacles that could have been identified earlier.

4. Employee Uncertainty and Attrition

Employee retention is undeniably one of the most significant challenges in M&A, as it directly impacts the success of integration and the realization of value from the deal. Uncertainty surrounding job security, role changes, and organizational culture can erode trust, lower morale, and drive key talent to seek opportunities elsewhere. Losing top performers disrupts operations and incurs additional costs and delays as organizations struggle to recruit and train replacements.

Middle managers play a pivotal role in bridging the gap between leadership and employees, fostering trust and alignment during the transition. Comprehensive staff training and a well–defined integration plan are also crucial to ensuring employees feel equipped and valued in the new environment. By prioritizing employee retention and fostering a sense of stability, organizations can preserve critical expertise, maintain business continuity, and set the foundation for the long-term success of the merger or acquisition.

5.Regulatory and Compliance Risks

M&A deals often face intense regulatory scrutiny, particularly in cross-border transactions where navigating complex legal, financial, and compliance requirements can pose significant challenges. These hurdles are especially prevalent in highly regulated industries such as healthcare, technology, and finance, where stringent standards must be met to proceed with a deal. The process can lead to delays, increased costs, or, in some cases, the abandonment of the transaction altogether.

Addressing regulatory risks early is critical to avoiding penalties, reputational damage, and operational disruptions. For instance, compliance with antitrust laws, data privacy regulations like GDPR, and foreign investment restrictions often introduces unforeseen obstacles. Notably, 30% of M&A deals encounter delays due to regulatory approvals, and 10% are abandoned entirely because of compliance issues. Proactive planning and expert guidance are essential to navigating these complexities and ensuring a smoother path to deal completion.

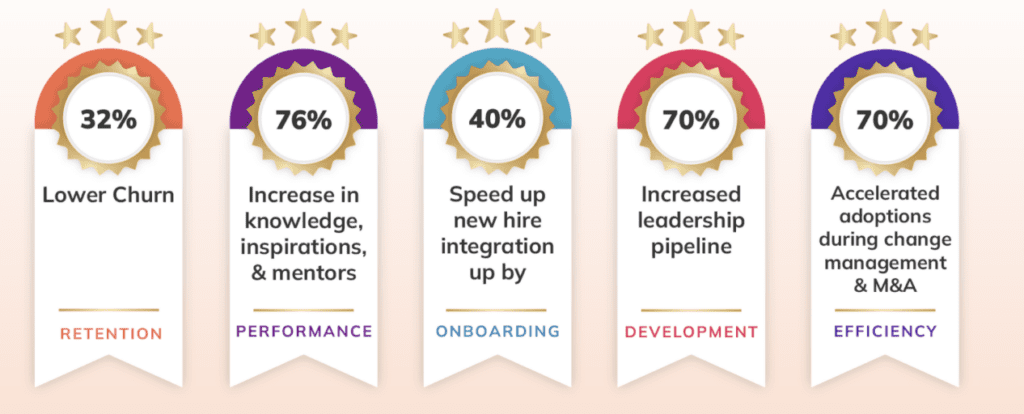

To effectively address these challenges, implementing robust change management strategies is essential. LEAD.bot offers a suite of features designed to support smooth transitions during M&A. These include Organizational Network Analysis (ONA), Watercooler microlearning, new hire onboarding, customized pulse surveys, and matching algorithms, all of which provide structured, innovative solutions to help manage change and ensure a seamless integration process.

LEAD.bot’s Innovative Features for M&A Success

1. Watercooler’s chats: Driving Cultural Education in M&A

A virtual watercooler can serve as a powerful solution to address cultural challenges during M&A integration by fostering collaboration, inclusivity, and engagement. By creating a digital space for informal interactions, employees from both organizations can connect, share experiences, and build relationships in a relaxed setting. This helps break down silos between teams and departments, ensuring that employees feel connected regardless of their original company or location. For example, activities like cross-cultural team-building exercises, storytelling sessions, or virtual “lunch and learn” events can help employees understand each other’s traditions, values, and work styles. These initiatives not only bridge cultural gaps but also build trust and reduce resistance to change, creating a more unified workforce.

In addition to fostering collaboration, the virtual watercooler promotes inclusivity by ensuring that remote or hybrid employees feel just as involved as those in the office. This is especially important during M&A, where employees may feel uncertain or anxious about the changes. By encouraging participation from everyone, the virtual watercooler helps create a sense of belonging and ensures that no one feels left out. It also serves as a platform for knowledge sharing, where employees can exchange insights, best practices, and cultural nuances from their respective organizations. This mutual learning fosters a more informed and cohesive workplace, aligning teams toward common goals.

Moreover, the virtual watercooler can incorporate fun and engaging activities, such as virtual games, quizzes, or themed events, to make the integration process more enjoyable. These lighthearted interactions reduce stress and help employees bond over shared experiences, making cultural integration feel more natural. At the same time, the platform can act as a feedback channel, allowing employees to voice concerns or share ideas about the integration process in real time. Leaders can use this input to address challenges, adapt strategies, and ensure that cultural integration efforts are effective and well-received. For instance, one of our clients used a water cooler feature to integrate two teams seamlessly after a merger. By this, they fostered open communication and created opportunities for employees to connect across departments, thereby reducing uncertainty, building trust, and accelerating cultural alignment.

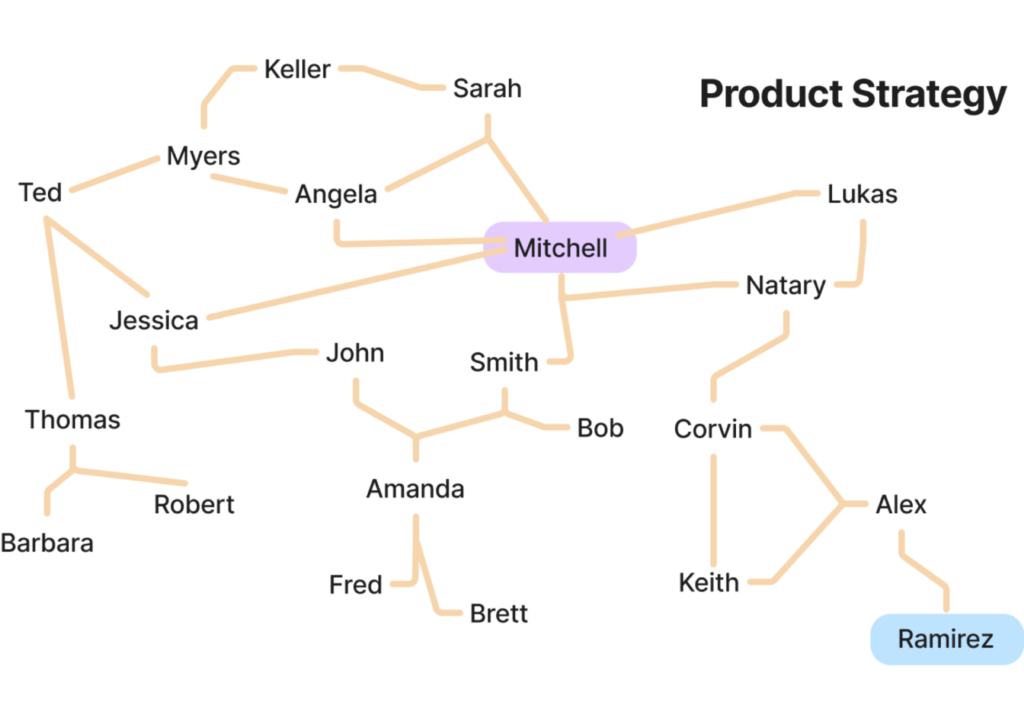

2. Organizational Network Analysis (ONA): Enhancing Collaboration in M&A

Organizational Network Analysis (ONA) is a powerful tool for visualizing and analyzing how employees connect and collaborate, making it particularly valuable during M&A integration. By mapping out the informal networks within and across the merging entities, ONA provides actionable insights that can drive smoother cultural and operational integration. For instance, it helps identify key influencers—individuals who naturally foster collaboration and act as bridges between teams. These influencers can serve as champions of change, helping to align cultures, communicate effectively, and drive adoption of new processes. Additionally, ONA highlights communication bottlenecks by revealing areas where information flow is limited or siloed. By addressing these gaps proactively, organizations can ensure that critical information reaches all stakeholders, reducing misunderstandings and fostering alignment.

Moreover, ONA provides real-time data on how well employees are connecting across the newly merged organization, allowing leaders to monitor integration progress and make informed decisions. This data-driven approach helps track the evolution of networks over time, assessing whether integration efforts are fostering collaboration or if additional interventions are needed. Beyond monitoring, ONA enables organizations to build stronger networks by understanding existing connections and identifying opportunities for new ones. For example, it can inform the creation of cross-functional teams, mentorship programs, or virtual watercooler activities that encourage interaction between employees from both entities.

By leveraging ONA, organizations can move beyond traditional hierarchies and focus on the actual patterns of interaction that drive productivity and innovation. This approach addresses cultural and operational challenges and builds a more cohesive and collaborative workplace, ensuring that employees from both organizations work together effectively toward shared goals. Ultimately, ONA enhances the success of M&A integration by fostering stronger connections and aligning teams for long-term success.

3. Pulse Surveys:Real-Time Feedback for Seamless M&A Integration

Pulse Surveys for Real-Time Feedback offer a significant advantage during M&A integration by providing leaders with actionable insights into employee sentiment. Short, frequent surveys allow organizations to gauge how employees feel about the integration process in real time. This immediate feedback helps leaders identify areas of concern, such as cultural misalignment, communication gaps, or resistance to change, before they escalate into larger issues. By addressing these concerns proactively, organizations can maintain morale and reduce the risk of attrition during the transition.

Additionally, it enables leaders to adapt their strategies dynamically. By tracking sentiment trends over time, organizations can fine-tune their change management approach to better meet the evolving needs of employees. For example, if surveys reveal that employees feel disconnected or uninformed, leaders can ramp up communication efforts or introduce initiatives like virtual watercooler sessions to foster engagement. This flexibility ensures that integration efforts remain aligned with employee expectations and organizational goals.

Moreover, pulse surveys empower employees to voice their opinions, fostering a culture of openness and trust. When employees feel heard and valued, they are more likely to embrace change and contribute positively to the integration process. By leveraging pulse surveys, organizations can create a more inclusive and responsive environment, ultimately driving the success of M&A initiatives and ensuring a smoother transition for all stakeholders.

4. Matching Algorithms: Building Stronger Relationships During M&A

Building relationships between employees from different organizations is a critical step in creating a unified culture during M&A. LEAD.bot’s matching algorithms offer a structured solution to foster these connections by pairing employees from both entities for meaningful interactions. For example, employees can be matched for one-on-one conversations or collaborative projects, enabling them to share insights, align on goals, and build trust. These cross-team connections help break down silos and promote collaboration, ensuring that employees feel integrated into the new organization.

Additionally, LEAD.bot facilitates mentorship opportunities by connecting senior leaders from both organizations with employees. This mentorship fosters knowledge exchange, mutual respect, and cultural understanding, which are essential for a smooth transition. By pairing experienced leaders with employees, organizations can bridge gaps in expertise and work styles, creating a more cohesive and supportive environment.

To further strengthen relationships, LEAD.bot supports social engagement initiatives like virtual coffee chats and team-building activities. These informal interactions allow employees to bond on a personal level, creating a sense of belonging and camaraderie. By fostering these connections, organizations can lay the foundation for a unified culture that drives innovation and collaboration, ultimately ensuring the success of the M&A integration.

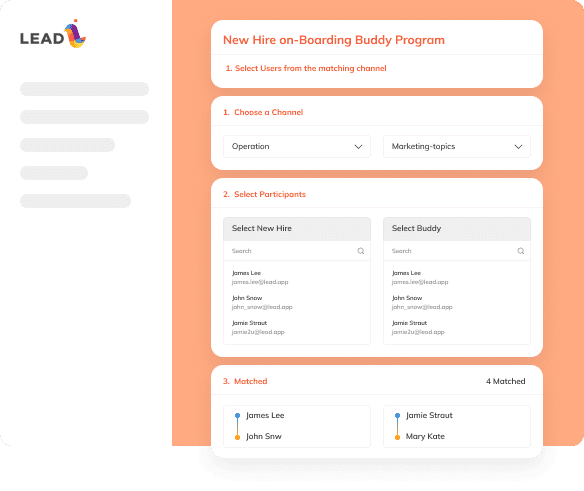

5.Effective Onboarding:Setting the Foundation for M&A Success

Effective onboarding is a critical solution to address employee uncertainty and attrition during M&A, ensuring that employees feel aligned with the new company’s goals and values. LEAD.app’s onboarding tools are designed to help organizations seamlessly integrate employees from both entities, fostering a sense of stability and belonging from day one. By providing a structured and engaging onboarding experience, LEAD.app helps new hires—whether from the acquiring or acquired company—understand their roles, the organizational culture, and how they contribute to the broader vision. This clarity reduces anxiety, builds trust, and minimizes the risk of attrition.

LEAD.app’s platform facilitates personalized onboarding journeys, ensuring that employees receive the information and support they need to succeed in the new environment. For example, it can pair new hires with mentors or buddies from the other organization, fostering cross-company relationships and knowledge sharing. Additionally, the platform offers interactive training modules and resources that align employees with the merged company’s goals, values, and processes. This equips employees with the tools they need to perform effectively and reinforces their sense of purpose and value within the organization.

For a 1,000-employee U.S. tech company, implementing LEAD.bot, a part of the LEAD.app platform can generate an estimated annual financial impact of $12.68M. This includes total annual savings of $12.08M, with $6.75M from churn prevention (3%), $2.25M from SME retention (5%), $750K from conflict resolution (10%), $2.25M from leadership retention (1%), and $500K from error reduction (0.5%). These results demonstrate the significant value LEAD.app provides by addressing employee engagement and retention challenges.

By leveraging LEAD.app’s onboarding solutions, organizations can create a smooth transition for employees, addressing their concerns and helping them feel connected to the new company. This approach preserves critical expertise and sets the foundation for long-term success by fostering alignment, engagement, and retention during the M&A process.

Conclusion: Unlocking the Full Potential of M&A Through Strategic Integration

In 2025, mergers and acquisitions (M&A) are surging as companies strive for growth, innovation, and a competitive edge. However, successful M&A requires the effective integration of cultures, processes, and people. Challenges such as cultural misalignment, communication gaps, regulatory hurdles, and employee uncertainty can undermine even the most well-planned deals. Tackling these challenges is essential to fully realizing the potential of M&A.

LEAD.bot emerges as a transformative solution to these challenges, offering a suite of tools designed to streamline M&A integration and foster long-term success. By leveraging features like Organizational Network Analysis (ONA), Watercooler, pulse surveys, and matching algorithms, LEAD.bot addresses the core pain points of M&A:

- Cultural Integration: LEAD.bot’s Viture Watercooler chats create spaces for employees to connect, share experiences, and build relationships, bridging cultural gaps and fostering a unified workforce.

- Communication and Transparency: With pulse surveys, LEAD.bot provides real-time insights into employee sentiment during M&A. Leaders can address concerns proactively, adapt strategies dynamically, and ensure employees feel heard and valued, reducing resistance to change.

- Collaboration and Relationship Building: LEAD.bot’s matching algorithms and ONA tools help break down silos by connecting employees across teams and departments. These features promote cross-functional collaboration, mentorship, and knowledge sharing, ensuring that employees from both organizations work together effectively toward shared goals.

- Employee Retention and Onboarding: M&A often creates uncertainty, leading to attrition. LEAD.bot’s onboarding tools provide a structured, engaging experience for new hires, helping them understand their roles, the merged culture, and their contribution to the broader vision. This reduces anxiety, builds trust, and retains critical talent.

- Regulatory and Compliance Risks: While LEAD.bot doesn’t directly address regulatory challenges, its tools for fostering communication and alignment can help organizations navigate these complexities more effectively by ensuring that teams are informed, engaged, and prepared for change.

In a world where M&A activity is on the rise, LEAD.bot stands ready to be your strategic partner, empowering you to navigate the complexities of integration with confidence. By fostering collaboration, transparency, and trust, we help mitigate the risks associated with M&A and unlock the full potential of these transformative deals.

As you pursue growth and innovation in an increasingly competitive landscape, we would love to be part of your journey. Together, we can turn the challenges of integration into opportunities for growth, innovation, and unity, ensuring that your mergers and acquisitions deliver on their promise of long-term success.

Come join us at lead.app and discover how LEAD.bot can transform your M&A experience. Let’s build the future of your organization—hand in hand. Your success is our mission, and we’re excited to be part of your story.